Six frugal-friendly tips to get the most out of shop loyalty cards

Last week, I asked about who uses supermarket loyalty cards – whether they’re a frugal necessity or something to be avoided.

Last week, I asked about who uses supermarket loyalty cards – whether they’re a frugal necessity or something to be avoided.

We had so many interesting responses that I thought it was worth summarising the excellent advice here. There *are* privacy implications and by using cards, you are generally making it easier for big companies to market their wares to you – but if you do want to use them, make sure you get the most out of them.

Turn them into vouchers/rewards

Lynsey said:

We have Tesco’s clubcard which is great as their vouchers can be turned into 3 times the face value for things like magazine subscriptions (we get ours using the vouchers) and it’s also very handy for us as you can turn them into Channel Tunnel vouchers so £30 of vouchers becomes £90 towards the crossing. We never use them in store for face value and always use them at 3x.

Jo of The Good Life also said:

I get quite a lot of vouchers back from Tesco which I use for meals out and magazine subscriptions. I’ve even had a RHS subscription and tickets to Gardener’s World Live though Clubcard Deals. You used to get four times the face value of the voucher if you spent them on rewards, but you now only get three times their value, but it’s still a great saving.

I’ve also seen the Frugal Queen talking about swapping her Tesco’s points into Cafe Rogue vouchers and my mum & dad swap them for magazine subscriptions and La Tasca (?) vouchers. If you’re already going to buy those magazines or dine in those places, this makes a lot of sense.

Resist their attempts to persuade you to spend money

Strowger78 said:

You have to be very careful! They will send you a blizzard of stupid vouchers for money off things that you don’t need. You must be disciplined and not use these.

And the same goes for those vouchers – they’re a waste of money if you wouldn’t normally buy those things.

Be inconsistent and they’ll reward you

Strowger78 also said:

The best results seem to come from not consistently shopping at one supermarket. If you always spend £100/wk at Tesco or Sainsburys, I think they confine themselves to offering you vouchers off things you don’t normally buy.If you aren’t consistent, they’ll eventually send you bundles of quite useful money-off vouchers. For example I’ve currently got a load of £7 off £70 and £5 off £50 Sainsburys and Tesco vouchers. They send these to try to entice you “back” to doing your “main” shop with them.

Link your card to bank accounts/utility bills for extra points

Lynsey has a Tesco credit card and gains points for money spent on her card. Meg had her Nectar card linked to her gas & electricity company (until her power company stopped doing that); other power companies have, at least in the past, been linked to Tesco for similar purposes. Cooperative dividend points are earned on just about anything in the Cooperative family – including bank accounts with The Cooperative Bank and Smile.

Use them when buying same-price-everywhere things

Shoestring said:

I use my Boots loyalty card to buy all of my make-up and most of my skincare stuff (I build up points by buying other stuff there, like my Vodafone top up voucher.

I didn’t know you could collect point on top-ups — do stamps count too?

But most importantly: forget points, use the cheapest option in the first place

Joddle said:

Privacy isn’t my issue with loyalty cards. I think the clue is in the name really. Once a loyalty card is signed up to, it may be so that people choose to spend more money in that particular shop than they might otherwise.I find that the cheap shops don’t offer loyalty cards as they keep their price point down in the first place. For example Boots = expensive; pound shop generally very cheap. Superdrug has recently started doing one, which blows my theory a bit.

I don’t consider Superdrug particularly cheap so maybe it doesn’t blow Joddle’s theory that much – but I agree with the rest: Wilkinsons, Home Bargain and the like offer name-brand toiletries for far cheaper than Boots (and Superdrug) – so much cheaper that points are very unlikely to make up the difference.

Any other great tips to add?

Read MoreWhy are you frugal? Poll update

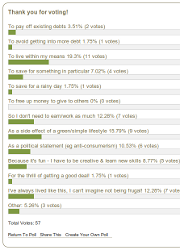

A couple of weeks ago, I set up poll asking what drives people’s frugality.

A couple of weeks ago, I set up poll asking what drives people’s frugality.

Part of the reason I asked is because a lot of frugal living blogs/personal finance sites are really focused around paying off debt. People detail their debts and progress in paying them off in their signatures on every comment/forum post – most of them are well in five figures and one person I saw talked about having US$1million of debt (!!). But that’s not why I’m frugal – and it’s not why a lot of people I know are frugal – so I wondered what it else it could be.

As of this morning, most people who voted were pro-actively frugal – just over 20% of people said they were either frugal to live within their means or to avoid getting into more debt, and just under 9% in order to save for something, mostly something in particular. Only 3.5% of people were doing it to pay off existing debt.

Adding to the proactively frugal number, over 26% are frugal as a side effect of living a simple/green life or for other political/philosophical reasons (such as anti-consumerism or stuff minimalisation), and another 12% said they were frugal so they didn’t have to work/earn as much.

Over 10% said they actively enjoy being frugal – mostly that they have to be creative and learn new skills to live on a tight budget. And another 12% said they’d always been frugal and couldn’t imagine living any other way.

I realise that the results are not necessarily representative of the population at large, even the frugal population at large, just a selection of the people who read this blog and took the time to vote, but I find it interesting all the same. We hear so much about debt – not just when on the personal finance sites I mentioned above but in the media – that it’s good to hear that not everyone is rampantly spending with free abandon.

Thanks to everyone who voted!

Read MoreMaking frugality & saving into a game?

I read this post the other day and thought it was an interesting idea.

It’s easy to stay focused and frugal when you have clear debts to pay off or when you’re saving something in particular, and it’s easy at the start when you can make huge changes to your outgoings by changing a few wasteful habits. But as time goes on, as those debts disappear/you met your immediate savings goal and it gets harder to cut back because you’re already as low as you can/are willing to go, it can get boring.

This post – Gaming the System: score points with your savings – suggests a couple of ways to make it into a bit of a game. I love the idea of getting the kids to reduce utility bills but worry about the situations when the reward is buying something…

As an avid strategy gamer though, it’s definitely something for me to think about.

Read More