Will we regret our frugalness?

At the weekend, I was catching up (online) with the Saturday papers from during my no spend period. We only buy the paper on Saturdays and not ever week – but I very much enjoy it when we do get it. I know I can read it all on the internet for free but every now and then it’s worth £1.90 to force me to get off my laptop for a few hours and it encourages me to read articles I wouldn’t seek out online.

So anyway, I was catching up with what I’d missed when I came across an article trying to be the opposite of every new year’s article: “How to be a better person in 2011: Abandon resolutions. Stop looking for a soulmate. Reject positive thinking“. The paragraph that caught my attention was, unsurprisingly, the one on frugality (about half way down the page):

Being bombarded daily by messages of financial catastrophe probably makes it easier to save money and avoid self-sabotaging shopping splurges. But it’s also an invitation to fall into the psychological trap known as “hyperopia”, or the opposite of shortsightedness: the tendency to deny oneself present-moment pleasures to a degree one subsequently comes to regret.

Experiments by the economists Daniel Kahneman and Amos Tversky show that people suffer short-term regret when they choose pleasure over work, but once a few years have passed, the situation flips: looking back over the years, people tend to feel far more regret at passed-up opportunities for pleasure, not work.

Personal finance writers love to preach the benefits of cutting back on daily hedonistic expenditures – the overpriced latte, the breakfast croissant. But the most efficient way to save money, obviously, is to cut out big expenditures, not small ones. And if small pleasures deliver a reliable daily mood boost, they may be better value, in terms of their cost-to-happiness ratio, than more pricey occasional purchases such as gadgets or clothes.

It’s all too easy to mistake the daily feeling of self-denial for the idea that you’re making significant savings, when in truth the two may not be closely related.

I’m not sure I’d agree with the idea that “the most efficient way to save money, obviously, is to cut out big expenditures, not small ones” (because “an overpriced latte [and] breakfast croissant” each day is, say, £4, which is £20 a week, £80 a month, nearly £1000 a year — I don’t make any easily avoidable £1000 purchases a year) but I think the rest of the section is interesting. I think it’s especially interesting that the reason I came to it a week late was because I’d forfeited a small pleasure with a decent cost-to-happiness ratio for the sake of frugality ;)

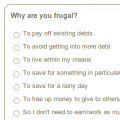

What do you think? If your frugality requires present-time denial (and whose doesn’t?), do you think you might regret it in the long run?

A story: ten years ago, when we were students/young graduates, a then-friend of mine’s dad told her to never say no to a night out – not wild expensive nights out, just a trip to the pub or the cinema – with friends because she didn’t think she could afford it. Sure, he was encouraging her to get into debt but he knew that she’d regret it more in the long run if she didn’t enjoy her youth. I thought it was some of the best dad advice ever and that summer – my only six months of singledom as an adult – I was out doing something or other six nights a week, lots of “daily hedonistic expenditure”, and even though I lived extremely frugally at home, my bank account was in the red the whole time. I don’t regret that in the slightest: it was lots of fun.

I don’t think I’m denying myself too much now – we’re not extremely frugal and still have plenty of treats/fun – but there are ways, big and little, where we hold ourselves back. In ten years time, who knows how I’ll feel about that…?

Meh. The trick is to find mood enhancing treats that aren’t necessarily based on spending. If I could choose a treat it would be more time with people I love or doing things I enjoy. The 20 minutes spent buying and drinking the latte I can spend knitting, or making a quick call to a mate, or taking a brisk walk which also lifts my mood.

I also get a lot of pleasure from reaching my savings goals. The $10 that I don’t spend on coffee and pastry today is going to buy us some great experiences when we travel to New Zealand in September. Yes, it is delayed gratification, but gratification none the less.

I concur with taphophile.

And I think short-term pleasures very occasionally are much more pleasurable than frequent indulgences that turn into under-appreciated habits (a problem the whole Western world has).

The key phrase I fixed on in the above quote is: “if small pleasures deliver a reliable daily mood boost…” That’s an awfully big IF. I’m with Linda here. Many, if not most, small pleasures repeated often enough to become thoroughly routine lose their ability to boost one’s mood. It’s human nature to take much for granted. And if a $4 splurge on coffee and croissant becomes the routine, then it’s probably just background, not a real pleasure. Granted, there are a few exceptions. I believe I truly savor every homemade breakfast of an egg from our own hens with toasted homemade bread – even though that’s breakfast several times a week. Maybe it’s because I’m eating what I’ve literally earned. In other areas I find that I need some space around my treats in order to appreciate them. Otherwise they’re not treats. In my opinion, that article was bad advice for the most part.

Wise words, team, as always :)

I strongly agree with kate & Linda that routine treats stop being treats and become habits – I used to use regularly timed sugary snacks to get me through the day at my last full time job, every day, snacks at 11am & 4pm, in addition to breakfast and lunch. The snacks stopped being proper treats and were more like markers – ultimately a waste of money and a gain of extra weight! I eventually solved the underlying problem (hating my job) by quitting and now enjoy occasional sugary treats considerably more.

Like Taphophile, I also get a kick out of the process of being frugal – I don’t have any particular savings goals at the moment but I like getting to the end of the week and totting up how little I’ve spent.

I think the article struck a chord with me because I worry sometimes that I’ve overly frugal in some arbitrary ways (random examples: telling John off for using three slices of bacon in a sandwich when two would have done, or wanting to keep the house cooler to save on heating bills) and I guess this article felt like a bit of a warning to not go too far.

Aside from that though, I think the point of the article was to deliberately be contrary – and I certainly won’t be using it as an excuse to run over to the coffee shop for croissants and coffee every day!

The other idea I always think about is that you should be happy to splurge on what you enjoy and not feel any pressure to buy things that others think you would want. Like for example some really nice Hammer or something weird like a tartan bed for the dog, and not feel any pressure to buy branded goods from supermarkets or M&S when friends come round for tea etc.

Chickens for example don’t pay for them selves however much I would like to think they do. Even my chainsaw probably doesn’t pay for the wood it gets through, given all the axes replacement chains, oil, petrol, 2 stroke oil, gloves, trousers, helmet & ear protectors, etc. soon enough it would have been cheaper to pay for central heating, but its what I enjoy, and I don’t care what anyone else thinks.

Hi Jan, The things you mention that may not be frugal now are actually a skills-investment in the future i.e. with chickens and the ability to process wood, you will never go hungry or cold.

It’s not very frugal to knit etc in these times of cheap imports but the skill retention is where the real economic value lies (+ the pleasure people derive from craft and lovingly made gifts)

Both great points.

I think as long as the activity isn’t costing me more in actual outgoings (ie, not including labour costs) and I enjoy it, then the skill building/resource security/sheer fun of it is well worth it.