No Spend November

I feel like I’ve been a spendy-spendy lately so am having a “No Spend November“.

I feel like I’ve been a spendy-spendy lately so am having a “No Spend November“.

Well, it’s not no spend because I still need to buy food for us (and the animals), and to pay for transport and stuff related to things I’ve already committed to (a gig and some courses), but “no more frivolous spending November” wasn’t quite so catchy ;)

I’ve not been going crazy with my spending but over the last few months, I’ve bought some (mostly charity shop/ebay-ed) clothes when I’ve not really needed them and have indulged a little too much in craft tools & supplies and books – and that all adds up. I thought it might be nice to pull back a bit and try to reset my spending gland.

If I have to buy something, I will but I’m doing a few things to hopefully make the whole “no spend” thing as painfree as possible.

Firstly, I’m doing NaNoWriMo again this year – NaNoWriMo has a habit of distracting me from everything else in my life, so I have less idle eBay/Ravelry/Pinterest browsing time. It also means I craft and read less so should not be quite so tempted to start new projects, or discover new books that I MUST READ NOW.

Speaking of those books, I’m going to remove my credit card from Paypal and Amazon again. They’re weak spots for me – with a saved credit card on file, it’s all too easy to buy inconsequential stuff – a £2 book or some sewing trimmings – without much thought. I need to stop that.

Next, I’m also going to take the opportunity to unsubscribe from a few of those ever-so-tempting shop newsletters before they begin their Christmas/New Year Sales onslaughts. I’ve already unsubscribed from a couple of email circulars but I definitely should unsubscribe from the handful of paper ones I receive as well.

Finally, I’m going to go out without my purse more often – just take the money I need for bus fare. I’ve started doing that when I go swimming – just taking my pre-paid card and £1 for my locker deposit, and it’s removed the temptation to go to the supermarket on the way home for a sweet reward. I think I might do the same for my weekly classes too, to remove the temptation of popping into charity shops while I’m nearby (mmm, nearby charity shops).

So that’s the plan – we’re seven days in of course, but I’ve stuck to it so far. Hope I can stick it out for the whole month!

Have you had any periods of deliberately not spending recently? Do you have any more tips to avoid temptation?

Read MoreMy winter to-do list 2013

(I wrote this last month but for some reason it didn’t get published – I only noticed when I came to tick stuff off — I’ve actually been powering through it compared to my normal slow productivity speed!)

Every year for the last few years, I’ve written myself a “preparing for winter” list for all those jobs that have to be done before the weather turns for the worst. I’m glad I can say I’ve FINALLY finished all the ones on my 2010 and 2011 lists now – well, except for the things that need doing again — it’s only taken me two or three winters!

Every year for the last few years, I’ve written myself a “preparing for winter” list for all those jobs that have to be done before the weather turns for the worst. I’m glad I can say I’ve FINALLY finished all the ones on my 2010 and 2011 lists now – well, except for the things that need doing again — it’s only taken me two or three winters!

Garden

The garden ones are similar to previous years – the routine stuff – though an afternoon in the garden last week has already ticked off some of the usual low hanging fruit (eg, tie up the low hanging fruit bushes!).

1. Tidy up the greenhouse & take any remaining tender plants into house for overwintering – I don’t think there is anything too tender in there but I’ll check.

2. Pop all terracotta containers or plastic ones holding delicate herbs into the greenhouse (and fleece if necessary) – this is a bigger job than in previous years as I bought lots of terracotta pots in the spring.

3. Add extra chippings to chicken run – John’s dad brought a load of chippings a few weeks ago but I’ll top them up again this month. Will hopefully stop it getting too muddy and/or freezing quite so solidly.

4. Sort out the wood pile, cut more “easy grab” logs & fill kindling bins inside and out – I’m out of my Sunday morning routine of clearing out the chicken coop and chopping the week’s kindling. I need to get back into that but a kindling buffer would be good too. We also need to shuffle our logs between the different stores – some of the ones further down in the garden should be seasoned enough now to come to the near the house store. (30/10/13 -Kindling bins are full for now, and we have quite a few “easy grab” logs – just need to keep the piles stocked up.)

5. Arrange for the tree surgeon to come over – we need to trim/cut down some trees but it isn’t safe for us to do it all by ourselves. We’ll do some and he can do the rest.

House

1. Fix cat flap in the kitchen so it isn’t so draughty – the magnet that holds the flap shut has gone. Should be fixable.

2. Fix the downstairs stove – a John job rather than one for me — something needs fire cementing again. We should also replace the cracked firebrick in the upstairs stove too. (30/10/13 – John has fixed the downstairs stove. Still need a new firebrick for upstairs though.)

3. Clean out gutters at front – after the leaves fall.

4. Wash the thicker, winter duvet – I really wish I’d thought to do this over summer but even the washing involves a trip to the laundrette and summer was rather chaotic. (30/10/13 – a kitten “accident” ensured this happened at the start of October. I washed the thin summer duvet at the same time.)

4b. Re-sew feather pockets as necessary – the feathers have been migrating through holes between the pockets.

5. Move more fragile plants out of the porch – and I guess, ditch the dying annuals from the herb shelf.

Us

I’m pretty well kitted out for winter this year – last year I got a new everyday winter coat, fab new winter boots, and lots of warm socks — in fact, I can’t wait for winter in that respect!

1. New wellies for me – I’ve worn my wellies just about every day for three years now and they’re beginning to show their age – worn soles and inners, and a hole in the shoe part. They’ll be fine for pottering but I’d prefer a new pair for dog walking etc. (30/10/13 – after discovering three new holes when I wandered into the sea at Ainsdale/Southport a couple of weeks ago, I finally got my act together and got my new boots last week.)

2. Scarf (and mittens? and hat?) for John – he has reappropriated my very long scarf but I’m going to make him a little Day of The Tentacle inspired one instead. Will make matching accessories if I have enough yarn left over. (30/10/13 – I started this a couple of weeks ago – not been working on it constantly but it’s nearly there. Another few evenings should do it.)

2b. Make a jumper & cardigan for me, and maybe felted slippers for John – this are maybes more than definitelys. (30/10/13 – jumper is finished, just need to tie in ends, go me! Yarn has arrived for the jumper.)

3. Tidy out our pantry/store-cupboard cupboards to get a good idea of what we’ve got and what we need (for us and the animals) – this is a sooner-rather-than-later one so we can stock up as necessary. We order our cat and dog food online so I’ll make sure we have a spare bag in store in case there are any problems with deliveries. Chicken feed is bought locally – but they sometimes have problems getting their deliveries in bad weather so again, I’ll buy an extra bag.

4. Buy a new stick blender – our old one, which has been a faithful kitchen friend for many years now, is on its way out (think: disturbing electrical crackling from within!) and I don’t think it’ll handle another souping season without dying spectacularly, shocking us or both.

5. Make pyjamas for Mum and a blanket for Mum & Dad’s bed – share the snuggy!

What have you got to do before the cold weather kicks in?

Read MoreTaking stock: a ‘what I’m up to in my absence’ meme

Inspired by Lynsey.

(For those not following me on Twitter, a few bits of news might be pertinent for understanding some of these. Firstly, our lovely old man-cat Boron died in June, which was sad but expected, and we got three new rescue kittens at the end of July – Matilda, Kaufman and Strange. They were 18weeks-ish old when we got them so they’re just under 6months old now so they’re hardly little kittens any more but they’re still very playful and very amusing. Second, I left my job at the theatre [teaching drama] in July – it was officially only a few hours a week but it took up considerably more time than that, both at the theatre and at home, and was crowding out my time & energy for other things — fun stuff and other work stuff. I’m now trying to decide what’s next.)

Making: a couple of blankets for the kittens – Tilda particularly like kneading blankets so I’m making some tiny ones for their beds. Strange is showcasing the first one above – it was very much a quicky (mostly made in a few hours while chatting and no blocking, hence the wiggly sides), made from leftover yarn

Cooking: with stuff from the freezer – there isn’t enough room for ice cream so we need to clear some space!

Drinking: too much tea but also water through a straw – I’ve discovered I drink far more water if I use a straw

Reading: after re-reading a few fiction favourites recently, I’m currently reading some books about treating anxiety and “In Tearing Haste: Letters Between Deborah Devonshire and Patrick Leigh Fermor” – it’s surprisingly endearing (all from the library).

Wanting: um, surprisingly very little at the moment.

Looking: at the animals dotted around the room – we’ve just given them their spot-on flea treatment (the kittens for the first time with us) and they’re giving us the stink eye back!

Playing: I played old school Tropico while I was ill after finishing drama (my usual post-production slump) but I think I’m done with it for now

Wasting: the last few weeks of summer in the garden – I had a really good handle on it until my crazy busy fortnight in July but it got overgrown while I was busy and now I have little enthusiasm for reining in the annuals. I’ll deal with the shrubs and perennials when the annuals die back.

Sewing: an embroidery of some tomato plants that I started back when my now triffid-like tomato plants were tiny seedlings – sewing has taken a backseat to crochet in the last few months but I think it’s very nearly finished

Wishing: for those around me to have a better next few months than the last few

Enjoying: having a little breather between commitments

Waiting: for my pottery and sewing courses to start in September

Liking: watching the kittens exploring the garden. I thought they’d go off on big adventures in the woods straight away but in their fortnight as inside/outside cats, they’ve mainly stayed in the garden — hiding behind big courgette leaves or amongst the strawberry plants to jump out on a passing sibling, bouncing between the different levels like it’s one big cat tree, and in Kaufman’s case, watching Chicken-TV from on top of the run.

Wondering: what I’ll be doing a year from now. So many possibilities!

Loving: how well our old Carla-cat and Lily-dog have coped with the new arrivals – there were a few awkward days but by and large, everyone has slotted together wonderfully. The picture below was taken at the weekend, a month after the kittens moved in – it’s Carla, Lily and Strange. Strange was the hardest to integrate – Lily would ignore the others but try to chase Strange and Strange hissed at Carla whenever they bumped into each other. As you can see, they got over the initial grumpiness. (Kaufman loves Lily the most though: he’s always going up to her for headrubs and tries to sleep next to her whenever she’ll let him. He even tried to feed from her once, which confused Lily no end!)

Hoping: Lily-dog will sleep tonight – she’s had a few bad nights this week (not uncommon in older dogs) and that’s meant I’ve had a few bad nights too. I was wandering around the garden with her at 2:30am this morning and it was probably nearer 5 before I got to sleep for the first time — and that was on the sofa in the office

Marvelling: at how organised and on top of things I seem to be at the moment – it’s a new thing! I’m not expecting it to last (especially if I remain sleep deprived) but I’m enjoying it in the meantime!

Needing: a few hours more sleep! Also, to do my daily chicken chores and get some work done.

Smelling: … animals smells. The flea stuff on the back of their necks, the litter tray… nice!

Hearing: the chickens clucking and next door’s little dog whining – because I just took the latter into her garden for a wee, which excited both her and our chickens!

Wearing: a boring black tshirt because due to the inclement weather over the last few years, about 90% of my tops have long or three-quarter length sleeves and I have a dearth of nice short sleeved shirts for actually warm days – this is one I use for my backstage “blacks”

Noticing: the timing of our local fruit this year- the cherry plums are late (and very sparse) and the blackberries are early. (Also, like Lynsey, I’ve noticed a lot of butterflies around this year, and lots of bees as well. I’d like to think I’ve made a more wildlife friendly garden and this is my reward but I think it’s just a coincidence!)

Bookmarking: lots of things on Pinterest and Ravelry, which has the unfortunate side effect of making me constantly want to do the next project rather than the one I’m currently working on. Also lots of things which may or may not be useful depending on which of the million paths I choose to pursue over the next few months.

Opening: all the doors and windows at all times – making the most of the weather before autumn kicks in and to make up for the stifling days during the last weeks of the heatwave, when we had to keep everywhere closed up to prevent the kittens escaping.

Giggling: at finding kitten teeth marks in odd things

Knowing: very little but

Thinking: lots of things!

Feeling: momentarily tired but content

Plummy solid square crochet blanket

This is the second crochet blanket I’ve made in two months. Yes, I know it’s June and gloriously sunny outside but what can I say? I live in the north of England and I’m realistic.

While I was finishing up my Ann Perkins blanket* at the end of April, I had a huge urge to make a solid square blanket: one colour per square like Heather’s Elmer blanket.

I used Stylecraft Special DK – I don’t usually like acrylic but this is alright. In the flesh, the colours are quite nice, it’s not quite as shiny as most synthetics and it’s super cheap. I used six colours: plum, grape, mocha, raspberry, parchment (nicely off white), and claret – the latter being my least favourite colour of the set, but I think it adds a nice contrast to all the purples.

Read MoreAttack of the Crochet Claw

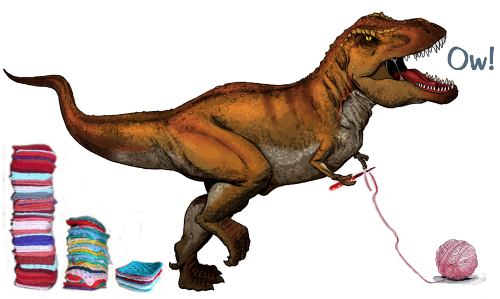

One of the reasons my crafting extravaganza hasn’t gone as planned is because of my hands. Between lots of wet felting, crochet and protecting my super-sensitive new scar over the last month, they’ve been slowly turning into T-Rex claws. But it wasn’t until Friday, when my knuckles were properly swollen and achy as well as stiff, that I actually thought about it seriously.

(Me, on Friday. Except I have curlier hair. And glasses. And a shorter tail.)

When I’m working at my computer, I’m pretty good at taking breaks, sitting in a good chair and doing little exercises to help reduce shoulder/eye strain etc. (I don’t use it any more but when I worked at the university, I used to use Workrave to keep me in line.) But for some reason, I don’t apply the same principle to crafting – I can sit curled up in a ball, on the sofa, for hours at a time, and the only exercise I do to break it up is occasionally tickle an animal or clasp my claw around a cup of tea. (This is a small exaggeration, but only a small one.)

As my dad has pretty bad osteoarthritis and I’ve had joint pain problems in the past (in my knees particularly), I’ve decided to take Claw Friday as a bit of a wake up call so it doesn’t get worse in the future. I’ve started breaking up my crafting like I do my computer time (and like any sensible, normal person would do) and switching between different things (eg between crochet and sewing over the weekend) rather than doing the same thing over and over again. I’m hoping to start going swimming again regularly from the summer onwards which will help things generally but in the meantime, I’ve also started doing some hand/forearm exercises that I remember from my yoga/pilates days – hopefully encouraging my muscles to become a little more flexible again. It’s amazing how just a few days of those has already improved things.

Do you do any particular exercises to help prevent RSI/other injuries during your crafting/making or gardening etc? Do you have any tips?

Read MoreTurning a box file into a sewing kit, pff too easy

Since most of April will be taken up with dramatic shenanigans, I decided that I should try to clear some things from my “WANT TO MAKE!!!” crafty to-do list during our short break over Easter. I found five small projects that I thought I could achieve in that time, as well as wanting to finish my big project from March (a big granny square blanket) and to block & frame some of embroidery/needlework projects from over the winter.

This was my first to-do – one driven by practical need rather than just creative want.

I bought a bulk load of cotton thread off the internet last week – it worked out about 30p per 500m reel rather than about three or four times that if I was buying them individually. I got them to replenish my very rundown sewing kit – I had run out of black thread, how does that even happens?! it’s like running out of teabags! – and I suspect they’ll last me years and years, as my last lot did. There are far too many reels to fit in my normal little sewing kit though so I decided one of my projects should be making a new sewing box – ooh, I thought, I could felt something, or sew something, or build something or adapt a vintage vanity case or something, it’ll be fun! Then after a few joyeous moments of running through the creative and fun ideas in my head, I realised a boring box file would be perfect for them.

I reclaimed an old file from some even older paperwork and I made some dividers out of scrap cardboard. The most time consuming bit was deciding how to arrange the colours ;) It was almost too easy – so much for having lots of creative, fun adventures making something! At least it was a freebie though.

It actually works pretty well – it’s easily portable and storable, and I can see all the colours in one go. The dividers, even with a bit of blu tac to stop them slipping down, aren’t strong enough to hold the reels in place when it’s upright and open, but they are fine when it’s closed. I can store related things in the other half of the box and I’m thinking of glueing some stiff cloth to the inside of the lid to hold needles and possibly add some little elastic loops for holding other tools.

It’s Day 5 of my break now and as well as a trip to Southport on Saturday, I’ve been doing various other things: I’ve doing some experimental crochet stuff (though not as much as I’d like due to sore hands, boo), some (machine) sewing on card and some embroidery. The first two haven’t gone quite as well as I’d hoped but lessons learnt etc, and I guess I’d be moaning about them being too easy if they had been a success ;) The embroidery is of a row of tomato plants, heavy with fruit – wishful-thinking stitching: the snow will melt and I will be able to garden soon, I will, I will!

Have you had any time for making things recently? If so, what have you been up to?

Read MoreCatching up with my crafting

2012 was my year that didn’t happen. A combination of circumstances and mood meant I achieved very little all year. It bummed me out until I just accepted it, and in comparison 2013 has been chipper and wonderfully productive.

I did a lot of embroidery and other hand-sewing in January and February – an combination of kits (to learn new skillz) and my own designs. This month has been crochet-tastic (I’m working on a big double-bed size blanket – 31 squares down, 23 to go) and I’ve also done some wet felting with resists. All Lily cares about though are the cushions I’ve made for us her.

I started them yesterday then ran out of thread so finished them today. Both days had intended to be garden days as I’ve got a whole bunch of seeds that need to be started ASAP but the eight inches of snow out there is getting in the way somewhat. I remember this week last year, sowing lots of seeds in the mini heatwave then watching them either rot in the soil or succumb to damping off when the weather turned again in April. I’ve not got anything tender on the go in the greenhouse/outside just yet though so this snow will delay things but hopefully won’t kill off much.

In case anyone is interested, the cushion covers are made from an Ikea fabric, Lappljung Randig, which is a lot nicer in person than it is on the web — and it should be because £8/metre isn’t super cheap. It’s a heavy cotton though, and it coordinates well with our grey sofa, and not just because both are covered in dog hair. (Lil is on her blue sofa in the office in the picture.) I bought the fabric back in February, on our usual Valentine’s Day visit to Ikea (it’s so quiet!) but as I nearly cut off the tip of my index finger the following morning, I couldn’t sew them until now. Two related #pro-tips:

Cushion sewing #pro-tip: Remember to open the zip before you finish stitching the final edge, else, annoyingly fiddly.

Cooking #pro-tip: Sharp, fast-spinning stick blender blades are SHARP and FAST-SPINNING.

I’ve got a strip of fabric left over, about 45cm wide and 2 metres long — I think we’ve got enough cushions now (if Lily shares) so I’m trying to think of ideas for it. I might get some fat quarters to coordinate with the colourful stripes and make a little lap quilt. That’ll have to wait its turn on the project list – I’ve got a year of craft ideas to work off first! (Speaking of which, I’ve been on Pinterest for ages for Recycle This but only just started Pinning non-recycling things – I’m louisaparry on there.)

What have you been up to?

Read More