The financial pros and cons for building up a food store/pantry

Writing about my “I’ll keep a store cupboard in case zombies attack!” paranoia yesterday (ahem) reminded me that I wrote something for a personal finance website last year but for some reason, didn’t get around to sending it over. I’ve re-edited it to make it suitable for here/now but have kept it purely about the financial side of things. I would love to hear your thoughts on it.

Over the last few years, we seem to be experiencing more and more cases of extreme weather and natural disasters. This year in the UK, we’ve had an unusually wet summer, leading to flooding, and elsewhere around the northern hemisphere, it’s been too hot, which has caused fires. There have also been unseasonal hurricanes/tornados, and while we’ve been comparatively lucky so far this year, 2011 was horrendous for other natural disasters such as the earthquakes in New Zealand and the earthquake/tsunami in Japan.

There’s no question that having a small supply for food and water is essential if bad weather is predicted and it’s important to maintain emergency supplies in case an unforeseen disaster strikes. But I’ve recently been considering the financial pros and cons of keeping a larger store pantry.

Why it makes financial sense to keep a large food store at home

Aside from the security of having emergency supplies when needed, the largest day-to-day benefits of maintaining a large store at home are the financial ones. Many people with large food stores grow and/or preserve a lot of their own food when it’s in season so have put-up supplies that are a lot cheaper than it would cost to buy them ready-made in the shops/out of season.

Aside from the security of having emergency supplies when needed, the largest day-to-day benefits of maintaining a large store at home are the financial ones. Many people with large food stores grow and/or preserve a lot of their own food when it’s in season so have put-up supplies that are a lot cheaper than it would cost to buy them ready-made in the shops/out of season.

Certain items (such as sacks of wheat berries, dried pulses or rice) can be bulk bought, resulting in a cheaper cost-per-serving, and in many places can also be bought direct from the producer or through a not-for-profit co-op, cutting the price even further.

Having a well-stocked store and list of “store-cupboard recipes” should also reduce the amount of times/frequency with which you visit your local supermarket. When you shop your own pantry, you’re not going to get persuaded to part with a few pounds on unnecessary temptations and treats. Depending on how far you are from your local shops, that may also save a considerable amount of money in fuel/public transport costs too, as well as time.

As well as saving money directly and indirectly in the first place, a large pantry is also essentially a saving scheme. In the UK interest rates on savings accounts are considerably lower than the rate of inflation so our bank savings are actually shrinking in real terms while food prices are rising. Items bulk-bought a year ago will have been cheaper in both ways: the sticker price will have been less and our actual money will have gone further too.

When keeping a large food store at home can cost you money

However, while our bank savings may be slowly shrinking, at least they’re not risk of going stale, mouldy or being eaten by rodents (or at least I hope not). Of course, those risks can be minimised with good stock rotation and appropriate storage containers – but purpose-bought storage containers can be expensive. Admittedly they’re reusable and you should get years of use from them but there is still an initial start-up cost. In fact, every aspect of creating a store cupboard involves upfront spending that some people may not be able to afford while living hand-to-mouth. It also requires ongoing maintenance and attention, time which might be better spent saving money elsewhere or increasing the household income someway.

However, while our bank savings may be slowly shrinking, at least they’re not risk of going stale, mouldy or being eaten by rodents (or at least I hope not). Of course, those risks can be minimised with good stock rotation and appropriate storage containers – but purpose-bought storage containers can be expensive. Admittedly they’re reusable and you should get years of use from them but there is still an initial start-up cost. In fact, every aspect of creating a store cupboard involves upfront spending that some people may not be able to afford while living hand-to-mouth. It also requires ongoing maintenance and attention, time which might be better spent saving money elsewhere or increasing the household income someway.

In places with very hot summers and cold or damp winters, extra care has to be taken about where the store is located to avoid spoilage – in practical terms, that generally means in air-conditioned/heated parts of the house rather than in an outhouse or garage. There are plenty of clever tips to “hide” bulk-bought items around the home but your heating/cooling bills may increase if you have to control temperature for the sake of the food when you’d ordinarily be out of the house (eg, during the day or on holiday). Food stored in freezers is obviously less affected by seasonal fluctuations but has a year-long power cost that should be considered: new, efficient freezers in suitable locations in the home are pretty cheap really but older, less efficient freezers cost far more to run. We usually keep our freezer well-stocked, with batch home-cooked “ready meals” and direct-from-the-local-farmer organic meat, which we buy in bulk but is still pretty expensive. If the freezer broke or we lost power for an extended period of time, we’d lose (or have to use ASAP) meat which represents a considerable amount of money. (Our household insurance would cover it, but with our excess, it wouldn’t be worth claiming.)

Aside from spoilage worries, tastes also change (especially in children) and dietary issues/allergies can develop, which could result in a lot of food you can no longer eat. If the food is still good, just no longer wanted, you could sell or barter the excess for something you can still eat – but there is still a chance that you’ll be left with money locked up in food that’ll ultimately go in the bin.

Are there any financial pros/cons on building up a food store/pantry that I’ve missed? Do you have any tips for setting up/maintaining a larder from a financial point of view?

(Can photo by CWMGary)

Read MoreStuff hangovers and aspirational buying

In this, the Decluttering season, I’ve been thinking a lot about stuff and about how it comes into our lives. My intention was to write this post about the idea of a “stuff hangover” but after reading an article on Get Rich Slowly, I think it’s about more than that.

In this, the Decluttering season, I’ve been thinking a lot about stuff and about how it comes into our lives. My intention was to write this post about the idea of a “stuff hangover” but after reading an article on Get Rich Slowly, I think it’s about more than that.

I suffer from a stuff hangover in several different areas – I’ve changed who I am and what I do but I’ve got stuff hanging over from previous versions of myself. For example, when I moved into our last house in 2000, I was straight out of university and I brought over all my uni notes, books and accoutrement. We brought a large proportion of those books and notes over here when we moved too even though I have long ago abandoned my post-grad plans in that area of study. Another thing: about five years ago, John wrote a comic strip that was quite popular in its incredibly nerdy niche and we sold t-shirts, stickers and badges based on the “characters” and in-jokes. The comic eventually wound up and when shirts sales reduced to a tickle, we took the shop offline too – but we still have a couple of boxes of stock leftover. Together the books/notes and t-shirts take up a fair amount of our storage space and because I see it regularly, I know I need to be brutal and get rid of it.

But there are smaller things that I’m blind to – the twenty pairs of trainer socks I cleared out from my sock drawer the other week were a smaller example, as are the various bits of jewellery I decluttered during last week’s mini-challenge. The jewellery hardly took up any space at all but it was there – in a jewellery box I didn’t use except to keep that unused jewellery in. It all adds up.

So that’s stuff from past-louisa still cluttering up life for present-louisa – the Get Rich Slowly article I mentioned at the start is, in part, about accumulating clutter/wasting money on things present-louisa wants to buy in order to be the perfect possible version of future-louisa: aspirational buying. The article (and comments) talk about things like when people buying exercise equipment because it’ll “force” them to keep fit, or buying the perfect dress or winter coat just because you like them, even though you never go anywhere nice or cold. The main focus of the article is about “buy for every day not special occasions“, which is something I’ve thought about before in terms of not getting use out of things because they’re saved “for best” but in this circumstance, it’s also about choosing a home or car that suits your every day needs not the once a year family get together, or camping trip (in both cases, it’s usually cheaper to pick something smaller and rent a hall/camper van when you need it, rather than having to pay for the extra cost, insurance etc).

Read MoreFirst half of 2011 spending breakdown

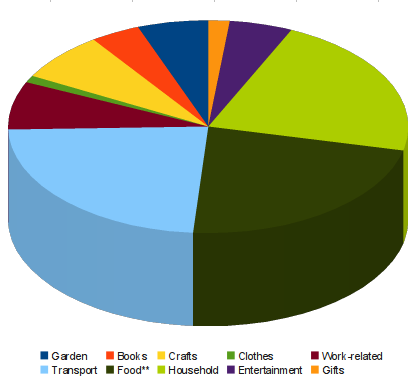

After the one I made for my June spending at lunchtime, I’m in a graph making mood so I’ve made one to show (myself) where my money has gone in the first half of 2011.

Here’s said graph:

And here’s the details in a table:

| Category | Spent | Percentage |

| Transport | £350.20 | 24% |

| Food** | £339.14 | 23% |

| Household | £326.73 | 21% |

| Crafts | £110.63 | 7% |

| Work-related | £109.15 | 7% |

| Garden | £85.73 | 6% |

| Entertainment | £76.59 | 5% |

| Books | £60.15 | 4% |

| Gifts | £25.84 | 2% |

| Clothes | £15.97 | 1% |

(** Takeout food and restaurant bills; my share of all bills or the total bill if I paid for everyone.)

Inspired by Shoestring Alley, I started tracking my spending at the start of the year and decided to record everything I spent “frivolously” – ie. not core bills or to-be-eaten/prepared-at-home food, but everything else. I wanted to start doing it to make me more conscious of my spending habits – to see where the money goes and to know that if I buy something silly/completely frivolous then I still have to hold myself accountable over it. A tool to help me reduce spending & consumption across the board.

It’s really worked – I’ve spent far less money on random things than I ever have done before. I’m actually really surprised how low “books” is as back when I was working full time, I could easily spend that on books each month and I got my money’s worth out of my book buying even then. (Disclaimer: most of the work-related stuff is books too, but books I wouldn’t ever buy or read if I didn’t need them – I would NOT be reading Shakespeare if I had a choice in it! ;) )

Apparently it takes just over two months to form a new habit and I think in the last six months, I have formed a habit of being conscious of my spending and not giving into temptation/the desire to buy things. Over the last month in particular, I’ve not spent a lot (by my previous standards) of frivolous money but I’ve not in any well felt hard done by, which is good, because that could lead to binge spending. There is still room to easily cut down – on lazy/convenience food, on pretty household stuff (related to us still settling in/decorating our house), and on craft supplies – but aside from food & travel costs, I’m pretty ok with it.

Do you track your spending? Do you find it motivating or restrictive?

Read MoreSome recent treats from blogland

I seem to have spent nearly all of today reading. No, not our many many books but blogs. I’ve read some great stuff so thought I’d share:

- First up, Failure Is An Option by The Greening of Gavin‘s Gavin. Oh my yes. I have “failed” so many times over the last few years – and every single time I learnt a lesson and will not repeat that mistake. I rarely use super expensive seeds and compost/pots can be reclaimed so it’s only costing my time to try, fail and learn not to do that again. I like hobbies which allow free/super cheap do-overs (I have frogged certain yarns oh so many times). Yes, failure is frustrating and it makes it feel like a waste of time but if you treat it as a learning curve then it’s not a waste, it’s a building block of knowledge.

- And speaking of minimising time expenditure, Fiona, The Cottage Smallholder, has been writing about perennial veg recently – tree cabbages and orach. (The latter isn’t perennial but is a self-seeder, and has a very long harvesting window.) Two interesting veggies to think about when I’ve got my “miniature forest garden” planning hat on.

- Changing the topic, I liked this post about avoiding slipping into the trap of always having to make the ultimate healthy homecooked food for every meal – especially when you’re just starting out. I’m a fan of gradual but steady changes that’ll stick rather than extreme shifts which might not. Looking back now, I’m amazed at some of our old habits or the way we used to cook things – but like with gardening, they were steps along the path which is taking us forward.

- It’s not a wise, overreaching philosophy for life like some of the other posts above but I really enjoy Jono’s Real Men Sow updates each month, working out exactly how much money he’s saved by growing his own. That’s how I’m going to keep track of our output this year too.

- And sticking with the super practical, I’m going to treat ManVsDebt‘s latest action list as a to-do list for the next few months. There is, obviously, an irony that some of my favourite recent blog posts have been all about action while I’ve been reading rather than acting today…

Have you read any good blog posts recently? Do share!

Read MoreApril – end of month review

April feels like it’s lasted forever – it’s not dragged in a bad way, just seems about four years since the end of March and the drama production (which finished on 9th April).

April has been a glorious month – gorgeous weather just about every day. *Too* glorious – there haven’t been any April showers around here and it’s mighty dry. I don’t want May or the summer to be a complete wash out but I wouldn’t mind the odd wet day.

Goals in 2011 progress

Since we’re a third of the way through the year, I’ve written a full update on my personal goals over on my blog. Out of the 11 goals and five sub-goals listed over there, I’ve completed one goal (and one sub-goal), six (and two) are in progress, and four (and two) are still to do.

I haven’t really made any separate progress on my additional Really Good Life goals – am reviewing them now to see what I can do over the next month.

Buy less than 12 items of clothing in 2011

Amazingly, I’ve still not bought anything – I’m genuinely shocked! I’ve online window shopped a couple of times – adding things to my basket but then forcing myself to wait until the next day to actually buy it. Each time I’ve been less enthused to finish the order the next day and just closed the tab instead. Saved a lot of money!

After March’s drawers sort through, I went shopping in my wardrobe for shirts in April – reminded myself what I had and found out what fit and what didn’t. I actually ended up getting rid of half the shirts in my wardrobe but have worn the remaining ones more since then so I actually feel like I’ve added to my options by doing that.

Growing stuff and the chickens

Read MoreMarch – end of month review

March has been a rather expensive and stressful month as we’ve been having our bathroom fitted and a ridiculous amount of things went wrong. But at the same time, we’ve also learnt some new skills and had some lovely Spring days – just how fantastic is it that the world is turning green again?

Goals in 2011 progress

As in February, I’m working towards a few goals if not anywhere near completing them yet. I’ve sown a lot of seeds for veg – unfortunately lost a lot of baby seedlings to damping off and other bad propagator management but I’m learning all the time. We should have our first fully homegrown 2011 salad in the next few weeks.

I’ve not been baking that much but the four loaves we made each on our baking course at the weekend keep up my average ;) They were sourdough loaves and we also now have starters from them – not quite growing one from scratch but I’ll be satisfied if I can keep that alive and bake from it.

We’ve also been on a screenprinting course – which isn’t one of the simple living goals mentioned here but is on my personal goals list – and enjoyed it a lot. We’re booked in for another session the week after next and I’ve already got a few things worked out that I’d like to print.

Buy less than 12 items of clothing in 2011

Even though I thought I’d cave this month, my tally is still at zero. I have been looking at things online but nothing has wowed me enough for me to get out my credit card. I did add some things to basket a couple of weeks ago but deliberately left it overnight to see how I felt about them in the morning – and in the morning, I was indifferent. I quite like that.

I think a Spring jacket may break my embargo – my short woolly swing coat is a little too warm at the moment but my hoodie is at the dog-walking stage of its lifecycle. We’ll see.

One other thing: one day, while putting away laundry, I sorted through all the t-shirts/tops I have in my chest of drawers. I didn’t get rid of anything, just tidied into related piles and refolded – I rediscovered a few tops which got looked over in the usual heap format of my drawers. Shopping your own wardrobe/drawers rules!

Growing stuff and the chickens

As I mentioned above, the growing stuff thing is going well-ish. I might live to regret it if there is a cold spell in the next few weeks but I planted out my broad bean seedlings yesterday. I’ve got two lots of potatoes sown in “bags”. My tomato seedlings – the ones that survived the Great Damping Off Crisis of 2011 – are beautifully leafy. My cucumbers and pumpkins look green and luscious. The chillis & peppers are growing slowly but looking good. The radish seedlings numerous, the cauliflowers hanging in there and various lettuce & salad leaves at varying stages of sprouting but looking very promising. On the fruit front, John B gave us some jostaberry canes so they’re in the ground too now. All our other berry bushes & fruit trees are budding/leafing well (the photo above is one of the apple trees), and the two strawberry runners that I thought had died have proved me wrong. Basically, it’s all go in the garden, greenhouse & propagator!

The chickens are doing well – they’ve met our nephew on a couple of occasions (our 4 year old niece comes to visit sometimes too, and John’s young cousins, but at 13 months old, the ‘phew is their youngest visitor to date) and got an new layer of woodchips to scratch around in. In return, they’ve given us a magnificent 200 eggs exactly (well, exact at this point – if I go down later, there may be another one). That’s an average of 6.45 a day, at a rough average of 8p per egg in consumables (£12 ish of food, and about £4 for straw, shavings, seed treats & powders).

Read More